A new analysis of global investments by venture capitalists in private companies focused on artificial intelligence (AI) found investments in AI to be growing at a dramatic pace. The United States (US) and the People’s Republic of China (hereafter “China”) are leading this wave of investments that tend to concentrate on a few key industries. The data showed that the European Union, Britain, and Japan increased investments, but lag behind the two dominant players:

Read the report

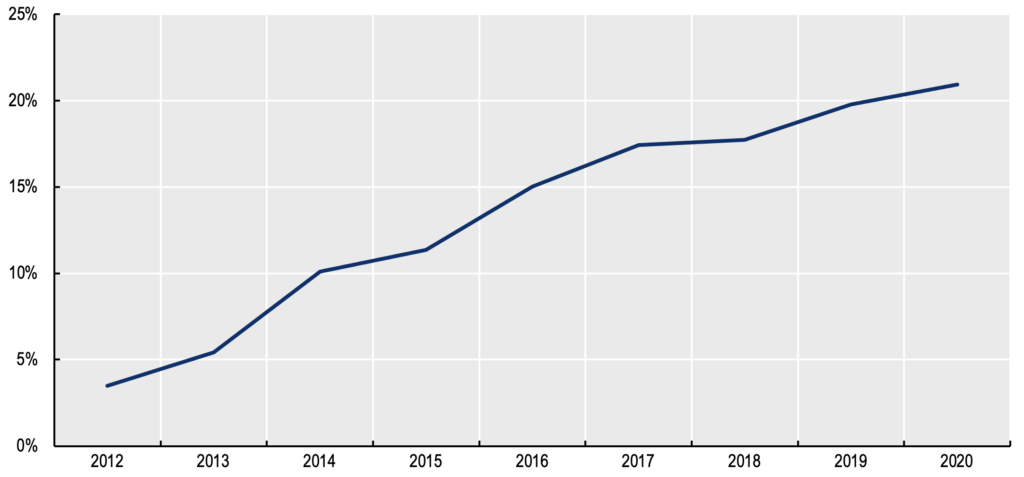

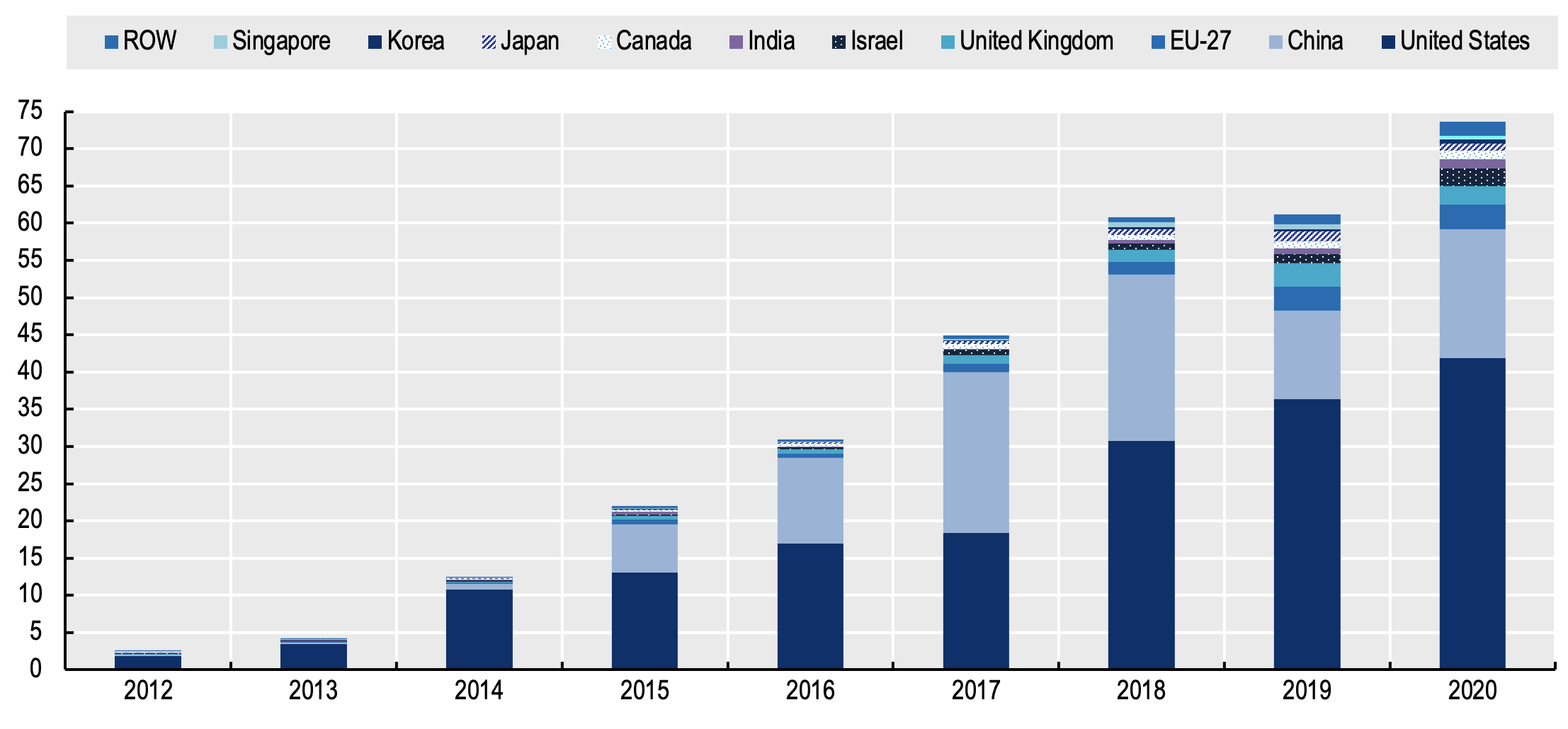

Share of total VC invested in AI

Source: OECD.AI (2021), processed by JSI AI Lab, Slovenia, based on Preqin data of 23/04/2021, www.oecd.ai.

RELATED >> Live data on investments in AI

The study analysed venture capital (VC) investments in 8 300 AI firms worldwide, covering 20 549 transactions between 2012 and 2020, based on data provided by Preqin, a private capital-markets analysis firm in London. The data did not capture every deal and required some extrapolation, and the data does not cover the internal investments in AI made by public companies. But the timeliness of the findings provides a valuable source of information as national governments, international organisations and the public and private sectors develop policies and strategies to capture the benefits of AI for all. In the present report, an ‘AI start-up’ or ‘AI firm’ is considered to be a private company that researches and delivers all or part of an AI system or researches and delivers products and services that rely significantly on AI systems. ‘AI start-up’ and ‘AI firm’ have the same meaning in the report. The definition of an AI system follows that of the OECD AI Principles: “An AI system is a machine-based system that is capable of influencing the environment by producing an output (predictions, recommendations or decisions) for a given set of objectives. It uses machine and/or human-based data and inputs to (i) perceive real and/or virtual environments; (ii) abstract these perceptions into models through analysis in an automated manner (e.g., with machine learning), or manually; and (iii) use model inference to formulate options for outcomes. AI systems are designed to operate with varying levels of autonomy”.

Growth of VC investments in AI

The global annual value of VC investments in AI firms has grown dramatically, from less than USD 3 billion in 2012 to close to USD 75 billion in 2020. Investments increased 20% last year alone. Start-up firms based in the United States and China absorbed more than 80% of investments in 2020. The European Union followed, with 4% and the United Kingdom and Israel, both at 3%. Within the EU, AI firms based in Germany and France accounted for about two-thirds of VC investments both in 2020 and since 2012.

Estimated value of VC investments in AI start-ups

Growth in AI investment in US-based firms has been steady from 2012 onwards, reaching USD 42 billion in 2020 (57% of the total). Investment in Chinese firms experienced a spike in 2017 and 2018, followed by a slump in 2019, representing USD 17 billion in 2020 (24%). VC investment in AI was distributed across more firms in the US than in China; the latter having more very large deals involving fewer firms.

Number of VC investments in AI start-ups

Source: OECD.AI (2021), processed by JSI AI Lab of Slovenia, based on Preqin data of 23/04/2021, www.oecd.ai.

The venture capital sector tends to forerun general investment trends, indicating the AI industry is maturing. As the AI industry matures, the median amount per investment is growing, there are more very large investments and proportionately fewer investment deals at early stages of financing.

VC investments by industry

Following investment flows helps identify hotspots for AI in the economy. Based on the data, the analysis identified AI firms in the three economic sectors that attracted the largest amount of investment:

- AI companies working on driverless vehicles and related mobility technologies attracted the most investments, drawing USD 19 billion of VC money in 2020 and USD 95 billion from 2012 to 2020. Those figures demonstrate the belief in AI’s huge potential to solve critical mobility and transportation challenges in future. Nearly all of those investments – 98% – were made in companies in China and the United States.

- The second-biggest sector for VC investment was healthcare, drugs and biotechnology, which attracted 16% of the total in 2020. Investments in these related industries doubled from USD 6 billion in 2019 to USD 12 billion in 2020, at least partly due to the COVID-19 pandemic.

- The broad category of business processes and support services ranked third in VC investments in 2020, accounting for 11% of the total. The level of investment reflected the growing recognition of the role AI can play in creating more efficient and cost-effective processes for business and government and the increase in automation.

Except for mobility and autonomous vehicles – a priority in both the US and China – VC investments in US, Chinese and EU27 AI firms targeted different industrial sectors:

- For AI start-ups based in the US the top industries were: mobility and autonomous vehicles (30% between 2012 and 2020); healthcare (13%); business processes and support services (11%); IT infrastructure and hosting (10%); and media, social platforms and marketing (8%); and financial and insurance services (7%).

- For Chinese AI start-ups the top industries were more focused: mobility and autonomous vehicles (41% of VC investments from 2012 to 2020); media, social platforms and marketing (14%); robots, sensors and IT hardware (13%); IT infrastructure & hosting (8%); and business processes and support services (7%).

- In the EU27, the top 5 industries between 2012 and 2020 were: media, social platforms and marketing (20%); business processes and support services (19%); financial and insurance services (16%); IT infrastructure and hosting (13%); and, healthcare, drugs and biotechnology (12%).

VC investors in AI

US VC investors were the most active investors in AI firms, representing 43% of the worldwide value of VC investments in AI in 2020, followed by Chinese investors (20%) and then EU27 investors (9%).

The US and China were net beneficiaries of AI VC investment from 2012 to 2020, i.e. American and Chinese AI firms funnelled more VC funds than US and Chinese VC investors distributed; while the opposite was true for the EU27, Japan, the UK and the rest of the world.

Both US and Chinese VC investors are dominant actors in their respective national markets but hold decreasing shares of each other’s markets. Chinese VC investors seemed more focused on China, investing only 16% of funds outside China between 2016 and 2020, while US VC investors invested 23% of funds outside the US. As a result, while Chinese VC investors represented 3% of AI VC investment in the US and 4% in the rest of the world in 2020, US VC investors represented 10% of AI VC investment in China and 23% in the rest of the world.

Investments in AI start-ups by country of the VC investors

Note: 20% of deals have investors from two or more countries, As the Preqin data does not specify how much each investor invested, the present report splits the value of these deals equally between investors. 15% of deals have no investors specified; the present report prorates the value of those deals equally to the deals with reported investors.

Source: OECD.AI (2021), processed by JSI AI Lab of Slovenia, based on Preqin data of 23/04/2021, www.oecd.ai.